Top 10 Options Strategies for Traders: Welcome to our comprehensive guide on the Top 10 Options Strategies for Traders. Whether you’re new to options trading or looking to enhance your existing knowledge, this article will provide you with a deep dive into the strategies that can help you navigate the markets with confidence. From covered calls to strangles, we’ll explore each strategy’s benefits, risks, and practical applications.

We suggest BOOKMARKING this page for future reference and SHARING this Article “Top 10 Options Strategies for Traders” with all your trader friends.

I. Introduction to Top 10 Options Strategies for Traders

Options trading offers traders of all levels a versatile way to capitalize on market movements while managing risk. Unlike traditional stock trading, options provide the opportunity to profit from price fluctuations without owning the underlying asset. This flexibility has made options strategies popular among traders seeking to diversify their portfolios and maximize returns.

In this comprehensive guide “Top 10 Options Strategies for Traders“, we’ll cover the top 10 options strategies that traders use to navigate various market conditions. Each strategy is designed to achieve specific objectives, whether it’s generating income, hedging against risk, or profiting from volatility. By understanding these strategies, you’ll be better equipped to make informed trading decisions and adapt to changing market dynamics.

II. Options Strategies for Traders: Understanding Options Basics

Before delving into the strategies, let’s establish a foundational understanding of options. An option is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an asset (such as stocks, ETFs, or commodities) at a specified price within a certain timeframe.

Key Concepts:

- Call Option: Gives the holder the right to buy the underlying asset at a predetermined price (strike price) before the expiration date.

- Put Option: Gives the holder the right to sell the underlying asset at a predetermined price (strike price) before the expiration date.

- Strike Price: The price at which the option holder can buy (for call options) or sell (for put options) the underlying asset.

- Expiration Date: The date by which the option must be exercised or it expires worthless.

- Premium: The price paid for the option contract.

Why Options?

Options provide traders with several advantages:

- Leverage: Options allow traders to control a larger position with a smaller amount of capital.

- Limited Risk: The most a trader can lose is the premium paid for the option.

- Flexibility: Options can be used in various ways, from speculation to hedging.

III. Benefits of Options Strategies

Options strategies are designed to achieve specific objectives based on market conditions and trader preferences. Here are some key benefits:

1. Income Generation

- Covered Call Strategy: This strategy involves selling a call option against a stock you already own. If the stock remains below the strike price, you keep the premium.

- Example: Let’s say you own 100 shares of XYZ stock trading at $50 per share. You sell a covered call with a strike price of $55 for a premium of $2 per share. If the stock stays below $55 by expiration, you keep the $2 premium.

2. Hedging Against Downside Risk

- Protective Put Strategy: Known as “insurance” for your portfolio, this strategy involves buying a put option to protect against a decline in the stock price.

- Example: If you own shares of ABC stock at $60 per share, you buy a put option with a strike price of $55 for a premium of $3 per share. If the stock falls below $55, the put option protects your investment.

3. Profiting from Volatility

- Long Straddle Strategy: This strategy involves buying a call option and a put option with the same strike price and expiration date.

- Example: If you expect a significant price movement in XYZ stock but are unsure of the direction, you can buy a call and a put option with a strike price of $50 each for $2 each. If the stock moves significantly in either direction, one of the options will profit.

4. Neutral Market Strategies

- Short Straddle Strategy: Involves selling a call option and a put option with the same strike price and expiration.

- Example: If XYZ stock is trading at $50 and you sell a call and put option with a strike price of $50 each for $3 each, you profit if the stock remains near $50 by expiration.

5. Combining Strategies

- Iron Condor Strategy: Combines a bear call spread and a bull put spread, creating a range-bound strategy.

- Example: You sell a call option with a strike price of $60 and buy a call option with a strike price of $65 (bear call spread), while also selling a put option with a strike price of $45 and buying a put option with a strike price of $40 (bull put spread). This strategy profits if the stock remains between $45 and $60 by expiration.

These are just a few examples of the many options strategies available to traders. Each strategy has its own risk-reward profile and is suitable for different market conditions.

IV. Top 10 Options Strategies for Traders: Factors to Consider Before Choosing an Options Strategy

Top 10 Options Strategies for Traders: Before implementing a specific options strategy, traders should consider several factors to align the strategy with their goals and risk tolerance.

Factors to Consider:

- Risk Tolerance: How much risk are you willing to take on for potential returns?

- Investment Goals: Are you looking for income, capital appreciation, or a combination?

- Market Outlook: Is the market bullish, bearish, or range-bound?

- Time Horizon: What is your timeframe for the trade or investment?

By assessing these factors, traders can select the most appropriate options strategy for their specific circumstances. It’s essential to have a clear plan in place before entering a trade.

Next, we’ll dive into each of the Top 10 Options Strategies for Traders in detail, exploring their mechanics, potential returns, and risk management techniques.

Please bookmark this comprehensive resource article “Top 10 Options Strategies for Traders” for future reference. Here are some Links for Further Investing Reading:

- Analyzing Market Trends: Insights and Strategies

- How to Build an Options Trading Plan

- Is Option Trading Better Than Stock Investing?

Continue reading for an in-depth exploration of each strategy and how it can be applied to your trading journey.

Table of Contents for this Top 10 Options Strategies for Traders:

- Covered Call Options Strategy

- Long Put Options Strategy

- Bull Put Spread Options Strategy

- Long Call Options Strategy

- Iron Condor Options Strategy

- Bull Call Spread Options Strategy

- Bear Put Spread Options Strategy

- Calendar Spread Options Strategy

- Protective Put Options Strategy

- Conclusion

1: Covered Call Options Strategy

The Covered Call Options Strategy is a popular options strategy among traders looking to generate income from their existing stock positions. It involves selling call options against stocks that you already own. This strategy allows you to collect premiums from the options while potentially earning additional income if the stock price remains below the strike price.

Mechanics of the Covered Call Options Strategy:

- Own the Underlying Stock: To implement this strategy, you must own shares of a stock in your portfolio.

- Sell Call Options: You then sell call options on those shares, typically at a strike price above the current market price.

- Collect Premiums: By selling the call options, you receive premiums from the buyer.

- Obligation to Sell: If the stock price rises above the strike price before expiration, the buyer of the call option may choose to exercise the option. In this case, you are obligated to sell your shares at the strike price.

Example Covered Call Options Strategy:

Let’s say you own 100 shares of XYZ stock, currently trading at $50 per share. You decide to sell a covered call with a strike price of $55 and receive a premium of $2 per share.

- Scenario 1: Stock Price Below Strike ($55) at Expiration

- The stock price remains below $55 at expiration.

- The call option expires worthless, and you keep the premium of $2 per share.

- You continue to own the stock and can sell another call option if desired.

- The stock price remains below $55 at expiration.

- Scenario 2: Stock Price Above Strike ($55) at Expiration

- The stock price rises above $55 at expiration.

- The call option buyer exercises their right to buy your shares at $55.

- You sell your shares at the strike price of $55, regardless of the current market price.

- In this case, your profit is the difference between the strike price and your initial purchase price ($55 – $50 = $5), plus the premium received ($2).

- The stock price rises above $55 at expiration.

Benefits of the Covered Call Options Strategy:

- Income Generation: The primary goal of this strategy is to generate income from the premiums received.

- Limited Downside: The premium received provides some downside protection if the stock price falls.

- Capital Appreciation: If the stock price remains below the strike price, you retain ownership and potential for capital gains.

Risks and Considerations:

- Limited Upside: Your potential profit is capped at the strike price, even if the stock price rises significantly.

- Obligation to Sell: There is a risk of having to sell your shares if the stock price rises above the strike price.

- Opportunity Cost: If the stock price rises sharply, you may miss out on potential gains above the strike price.

Covered Call Options Strategy Real-World Example:

Let’s look at a real-world example of the Covered Call Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Number of Shares Owned: 200

- Option Contract: Sell 2 Call Options with a Strike Price of $65

- Premium Received: $3 per share

Scenario:

- Outcome 1 (Stock Price Below Strike):

- Stock remains below $65 at expiration.

- Keep the premium of $3 per share.

- Total Premium: $3 x 200 shares = $600

- Stock remains below $65 at expiration.

- Outcome 2 (Stock Price Above Strike):

- Stock price rises to $70 at expiration.

- Obligated to sell shares at $65 (strike price).

- Profit from stock appreciation: $65 – $60 = $5 per share.

- Total Profit: $5 x 200 shares = $1,000

- Total Premium: $600

- Total Profit with Premium: $1,000 + $600 = $1,600

- Stock price rises to $70 at expiration.

Conclusion

The Covered Call Options Strategy can be an effective way to generate income from existing stock positions while providing some downside protection. However, it’s essential to consider the potential risks and the opportunity cost of limiting upside potential. Traders should carefully assess their risk tolerance and market outlook before implementing this strategy.

2: Protective Put Options Strategy

The Protective Put Options Strategy is a risk management strategy that allows traders to protect their stock positions from downside risk. It involves purchasing put options to offset potential losses in the underlying stock. This strategy is particularly useful when a trader wants to maintain ownership of the stock while limiting their risk in case of a price decline.

Mechanics of the Protective Put Options Strategy:

- Own the Underlying Stock: Like the Covered Call Strategy, this strategy requires owning shares of a stock.

- Buy Put Options: You then buy put options on those shares, typically at a strike price below the current market price.

- Protection Against Losses: If the stock price falls below the strike price of the put option, the put option provides downside protection.

- Cost of Protection: The premium paid for the put option is the cost of insurance against a potential decline in the stock price.

Protective Put Options Strategy Example:

Let’s say you own 100 shares of XYZ stock, currently trading at $50 per share. Concerned about a potential market downturn, you decide to buy a put option with a strike price of $45 for a premium of $2 per share.

- Scenario 1: Stock Price Above Strike ($45) at Expiration

- The stock price remains above $45 at expiration.

- The put option expires worthless, and you lose the premium of $2 per share.

- However, your stock position remains intact.

- The stock price remains above $45 at expiration.

- Scenario 2: Stock Price Below Strike ($45) at Expiration

- The stock price falls below $45 at expiration.

- The put option provides protection, allowing you to sell your shares at the strike price of $45.

- This limits your loss to $45 – $2 (premium) = $43 per share.

- The stock price falls below $45 at expiration.

Benefits of the Protective Put Options Strategy:

- Downside Protection: Provides insurance against potential losses in the stock.

- Maintains Stock Ownership: Unlike selling the stock, this strategy allows you to maintain ownership.

- Peace of Mind: Reduces anxiety during volatile market conditions.

Risks and Considerations:

- Cost of Insurance: The premium paid for the put option is an additional cost.

- Limited Upside: If the stock price rises, the put option may expire worthless.

- Expiration Date: The protection is only valid until the expiration date of the put option.

Protective Put Options Strategy Real-World Example:

Let’s look at a real-world example of the Protective Put Strategy in action:

- Stock: Company ABC

- Current Stock Price: $55 per share

- Number of Shares Owned: 150

- Option Contract: Buy 1 Put Option with a Strike Price of $50

- Premium Paid: $3 per share

Scenario:

- Outcome 1 (Stock Price Above Strike):

- Stock remains above $50 at expiration.

- The put option expires worthless, and you lose the premium of $3 per share.

- Total Premium Paid: $3 x 150 shares = $450

- Stock remains above $50 at expiration.

- Outcome 2 (Stock Price Below Strike):

- Stock price falls to $45 at expiration.

- Exercise the put option, selling shares at $50 (strike price).

- Limit loss to $50 – $45 = $5 per share.

- Total Loss: $5 x 150 shares = $750

- Total Premium Paid: $450

- Total Loss with Premium: $750 – $450 = $300

- Stock price falls to $45 at expiration.

Conclusion

The Protective Put Options Strategy is a valuable tool for traders seeking to protect their stock positions from downside risk. While it comes with a cost (the premium of the put option), it provides peace of mind and a defined level of protection against adverse market movements.

3: Long Straddle Options Strategy

The Long Straddle Options Strategy is an options strategy that involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when a trader expects a significant price movement in the underlying stock but is unsure of the direction. It allows the trader to profit from volatility, regardless of whether the stock price moves up or down.

Mechanics of the Long Straddle Options Strategy:

- Buy Call Option: Purchase a call option on the stock.

- Buy Put Option: Simultaneously buy a put option on the same stock.

- Same Strike Price and Expiration: Both options have the same strike price and expiration date.

- Profit from Volatility: The strategy profits if the stock price moves significantly in either direction.

Long Straddle Options Strategy Example:

Let’s say you’re considering the Long Straddle Strategy for XYZ stock, currently trading at $50 per share. You buy a call option and a put option with a strike price of $50 each, both with a premium of $2 per share.

- Scenario 1: Stock Price Below $50 at Expiration

- The stock price remains below $50 at expiration.

- Both options expire worthless

. - Total Loss: $2 (call) + $2 (put) = $4 per share.

- The stock price remains below $50 at expiration.

- Scenario 2: Stock Price Above $50 at Expiration

- The stock price rises above $50 at expiration.

- The call option is in-the-money, and the put option expires worthless.

- Total Profit: Stock Price – Strike Price – Premium Paid = ($55 – $50 – $2) = $3 per share.

- The stock price rises above $50 at expiration.

- Scenario 3: Stock Price Below $50 at Expiration

- The stock price falls below $50 at expiration.

- The put option is in-the-money, and the call option expires worthless.

- Total Profit: Strike Price – Stock Price – Premium Paid = ($50 – $45 – $2) = $3 per share.

- The stock price falls below $50 at expiration.

Benefits of the Long Straddle Options Strategy:

- Profit from Volatility: Regardless of the direction of the stock price movement, the strategy profits from significant price swings.

- Limited Risk: The maximum loss is limited to the combined premiums paid for the call and put options.

- Hedging Uncertainty: Useful when expecting a big move in the stock but uncertain about the direction.

Risks and Considerations:

- Cost of Strategy: Buying both call and put options involves paying two premiums.

- Time Decay: The value of both options decreases over time, particularly if the stock price remains stable.

- Stock Movement Required: The stock must make a significant move to be profitable.

Long Straddle Options Strategy Real-World Example:

Let’s look at a real-world example of the Long Straddle Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Option Contracts: Buy 1 Call Option and 1 Put Option with a Strike Price of $60

- Premium Paid: $4 per share (for both options)

Scenario:

- Outcome 1 (Stock Price Below $60):

- Stock remains below $60 at expiration.

- Both options expire worthless.

- Total Loss: $4 per share (premium paid).

- Stock remains below $60 at expiration.

- Outcome 2 (Stock Price Above $60):

- Stock price rises to $70 at expiration.

- The call option is in-the-money, and the put option expires worthless.

- Total Profit: $70 – $60 – $4 = $6 per share.

- Stock price rises to $70 at expiration.

- Outcome 3 (Stock Price Below $60):

- Stock price falls to $50 at expiration.

- The put option is in-the-money, and the call option expires worthless.

- Total Profit: $60 – $50 – $4 = $6 per share.

- Stock price falls to $50 at expiration.

Conclusion

The Long Straddle Options Strategy is a versatile strategy that allows traders to profit from volatility without predicting the direction of the stock price movement. While it requires a significant price movement to be profitable, it can be an effective tool in volatile markets or around earnings announcements.

4: Short Straddle Options Strategy

The Short Straddle Options Strategy is an options strategy that involves selling both a call option and a put option with the same strike price and expiration date. This strategy is used when a trader expects the underlying stock to remain relatively stable within a certain range. The goal is to profit from the premium received from selling the options, as long as the stock price remains near the strike price.

Mechanics of the Short Straddle Options Strategy:

- Sell Call Option: Sell a call option on the stock.

- Sell Put Option: Simultaneously sell a put option on the same stock.

- Same Strike Price and Expiration: Both options have the same strike price and expiration date.

- Profit from Theta Decay: The strategy profits from time decay (theta) as long as the stock price remains near the strike price.

Short Straddle Options Strategy Example:

Let’s say you’re considering the Short Straddle Strategy for XYZ stock, currently trading at $50 per share. You sell a call option and a put option with a strike price of $50 each, both with a premium of $3 per share.

- Scenario 1: Stock Price Below $50 at Expiration

- The stock price remains below $50 at expiration.

- Both options expire worthless.

- Total Profit: $3 (call premium) + $3 (put premium) = $6 per share.

- The stock price remains below $50 at expiration.

- Scenario 2: Stock Price Above $50 at Expiration

- The stock price rises above $50 at expiration.

- The call option is in-the-money, and the put option expires worthless.

- Total Loss: Stock Price – Strike Price – Premium Received = ($55 – $50 – $6) = $1 per share.

- The stock price rises above $50 at expiration.

- Scenario 3: Stock Price Below $50 at Expiration

- The stock price falls below $50 at expiration.

- The put option is in-the-money, and the call option expires worthless.

- Total Loss: Strike Price – Stock Price – Premium Received = ($50 – $45 – $6) = $1 per share.

- The stock price falls below $50 at expiration.

Benefits of the Short Straddle Options Strategy:

- Profit from Time Decay: The strategy benefits from time decay as the options approach expiration.

- Stable Stock Price: Ideal for stable or range-bound stocks where the price is expected to remain near the strike price.

- Limited Risk: The maximum profit is the total premium received, while the maximum loss is capped at the difference between the strike price and the total premium received.

Risks and Considerations:

- Unlimited Risk: If the stock price makes a significant move in either direction, the losses can be substantial.

- Margin Requirements: Selling options may require margin, depending on the broker’s requirements.

- Stock Movement: The stock must remain relatively stable for the strategy to be profitable.

Short Straddle Options Strategy Real-World Example:

Let’s look at a real-world example of the Short Straddle Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Option Contracts: Sell 1 Call Option and 1 Put Option with a Strike Price of $60

- Premium Received: $4 per share (for both options)

Scenario:

- Outcome 1 (Stock Price Below $60):

- Stock remains below $60 at expiration.

- Both options expire worthless.

- Total Profit: $4 per share (premium received).

- Stock remains below $60 at expiration.

- Outcome 2 (Stock Price Above $60):

- Stock price rises to $70 at expiration.

- The call option is in-the-money, and the put option expires worthless.

- Total Loss: $70 – $60 – $4 = $6 per share.

- Stock price rises to $70 at expiration.

- Outcome 3 (Stock Price Below $60):

- Stock price falls to $50 at expiration.

- The put option is in-the-money, and the call option expires worthless.

- Total Loss: $60 – $50 – $4 = $6 per share.

- Stock price falls to $50 at expiration.

Conclusion

The Short Straddle Options Strategy is a strategy for traders who expect a stock to remain relatively stable and profit from time decay. However, it comes with the risk of unlimited losses if the stock price makes a significant move. Traders should carefully assess the market conditions and their risk tolerance before implementing this strategy.

5: Top 10 Options Iron Condor Options Strategy

The Iron Condor Options Strategy is an options strategy that combines a bear call spread and a bull put spread. It is used when a trader expects the underlying stock to remain within a certain range of prices. The goal is to profit from the premium received from selling both call and put options, while limiting potential losses through defined risk parameters.

Mechanics of the Iron Condor Options Strategy:

- Sell Call Spread: Sell a call option with a higher strike price and simultaneously buy a call option with an even higher strike price.

- Sell Put Spread: Sell a put option with a lower strike price and simultaneously buy a put option with an even lower strike price.

- Same Expiration Date: Both call and put options have the same expiration date.

- Profit from Range-Bound Stock Price: The strategy profits if the stock price remains within the range of the strike prices.

Iron Condor Options Strategy Example:

Let’s say you’re considering the Iron Condor Strategy for XYZ stock, currently trading at $50 per share. You create the following spreads:

- Call Spread: Sell a call option with a strike price of $55 and buy a call option with a strike price of $60.

- Put Spread: Sell a put option with a strike price of $45 and buy a put option with a strike price of $40.

Scenario:

- Outcome 1: Stock Price Below $45 at Expiration

- Both the call and put options expire worthless.

- Total Profit: Combined premiums received for selling both spreads.

- Both the call and put options expire worthless.

- Outcome 2: Stock Price Above $60 at Expiration

- The call spread results in a loss, but the put spread expires worthless.

- Total Loss: Difference between strike prices of the call spread, minus the premiums received.

- The call spread results in a loss, but the put spread expires worthless.

- Outcome 3: Stock Price Between $45 and $60 at Expiration

- Both spreads expire worthless.

- Total Profit: Combined premiums received for selling both spreads.

- Both spreads expire worthless.

Benefits of the Iron Condor Options Strategy:

- Defined Risk and Reward: The maximum profit and loss are known upfront.

- Profit from Time Decay: The strategy benefits from time decay as long as the stock price remains within the range.

- Ideal for Range-Bound Stocks: Works best when the trader expects the stock to trade within a specific range.

Risks and Considerations:

- Limited Profit Potential: The maximum profit is the combined premiums received for selling the spreads.

- Limited Losses: The maximum loss is the difference between the strike prices of the spreads, minus the premiums received.

- Margin Requirements: Depending on the broker, this strategy may require margin.

Iron Condor Options Strategy Real-World Example:

Let’s look at a real-world example of the Iron Condor Strategy in action:

- Stock: Company ABC

- Current Stock Price: $55 per share

- Option Contracts:

- Sell 1 Call Option with a Strike Price of $60

- Buy 1 Call Option with a Strike Price of $65

- Sell 1 Put Option with a Strike Price of $50

- Buy 1 Put Option with a Strike Price of $45

- Sell 1 Call Option with a Strike Price of $60

- Premiums Received: $2 per share for each spread

Scenario:

- Outcome 1 (Stock Price Below $45 or Above $60):

- Both spreads expire worthless.

- Total Profit: $2 (call spread) + $2 (put spread) = $4 per share.

- Both spreads expire worthless.

- Outcome 2 (Stock Price Between $45 and $60):

- Both spreads expire worthless.

- Total Profit: $4 per share.

- Both spreads expire worthless.

- Maximum Loss Scenario:

- Stock price at $70 at expiration.

- Call spread: ($70 – $60) – $4 = $6 loss per share.

- Put spread: $4 loss per share.

- Total Loss: $6 (call spread) + $4 (put spread) = $10 per share.

- Stock price at $70 at expiration.

Conclusion

The Iron Condor Options Strategy is a versatile strategy for traders who expect a stock to remain within a specific range. It provides defined risk and reward parameters, making it suitable for range-bound markets. Traders should carefully assess the potential profit and loss scenarios before implementing this strategy.

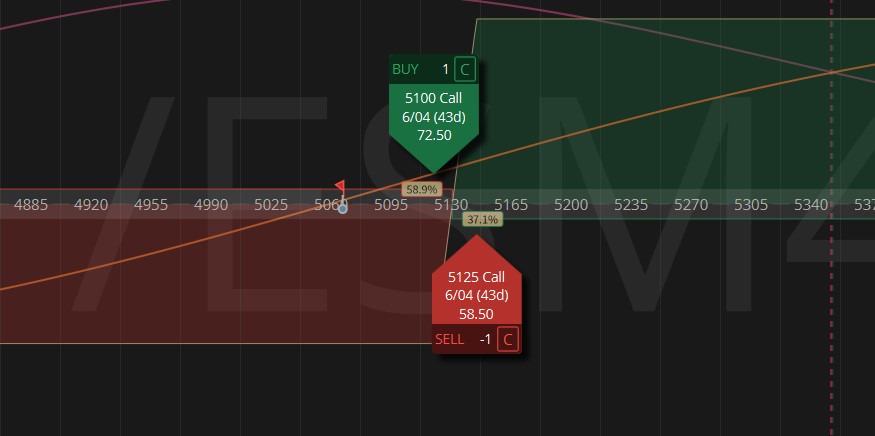

6: Top 10 Options Bull Call Spread Options Strategy

The Bull Call Spread Options Strategy, also known as a “long call spread” or “debit call spread,” is an options strategy used when a trader is moderately bullish on a stock’s price. It involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy allows the trader to profit from a potential upward movement in the stock price while reducing the cost of entering the trade.

Mechanics of the Bull Call Spread Options Strategy:

- Buy Call Option: Purchase a call option with a lower strike price.

- Sell Call Option: Simultaneously sell a call option with a higher strike price.

- Same Expiration Date: Both call options have the same expiration date.

- Limited Risk, Limited Reward: The maximum loss and profit are limited.

Bull Call Spread Options Strategy Example:

Let’s say you’re considering the Bull Call Spread Strategy for XYZ stock, currently trading at $50 per share. You create the following spread:

- Buy Call Option: Strike Price $50, Premium $3 per share

- Sell Call Option: Strike Price $55, Premium $1 per share

Scenario:

- Outcome 1: Stock Price Below $50 at Expiration

- Both call options expire worthless.

- Total Loss: Combined premiums paid for both options.

- Both call options expire worthless.

- Outcome 2: Stock Price Between $50 and $55 at Expiration

- The lower strike call option is in-the-money, and the higher strike call option expires worthless.

- Total Profit: Difference between the strike prices minus the combined premiums paid.

- The lower strike call option is in-the-money, and the higher strike call option expires worthless.

- Outcome 3: Stock Price Above $55 at Expiration

- Both call options are in-the-money.

- Total Profit: Maximum profit achieved when the stock price is above the higher strike price ($55), minus the combined premiums paid.

- Both call options are in-the-money.

Top 10 Options Strategies for Traders: Benefits of the Bull Call Spread Options Strategy:

- Limited Risk: The maximum loss is limited to the combined premiums paid for the call options.

- Reduced Cost: Selling the higher strike call option helps offset the cost of buying the lower strike call option.

- Profit from Upside: The strategy profits from an upward movement in the stock price.

Risks and Considerations:

- Limited Profit Potential: The maximum profit is capped at the difference between the strike prices, minus the combined premiums paid.

- Stock Movement Required: The stock must rise to a certain level to be profitable.

- Time Decay: The value of the options decreases as expiration approaches.

Bull Call Spread Options Strategy Real-World Example:

Let’s look at a real-world example of the Bull Call Spread Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Option Contracts:

- Buy 1 Call Option with a Strike Price of $60, Premium $4 per share

- Sell 1 Call Option with a Strike Price of $65, Premium $2 per share

- Buy 1 Call Option with a Strike Price of $60, Premium $4 per share

Scenario:

- Outcome 1 (Stock Price Below $60):

- Both call options expire worthless.

- Total Loss: $4 (premium paid for lower strike call) – $2 (premium received for higher strike call) = $2 per share.

- Both call options expire worthless.

- Outcome 2 (Stock Price Between $60 and $65):

- The lower strike call option is in-the-money, and the higher strike call option expires worthless.

- Total Profit: $5 (difference between $65 and $60 strike prices) – $2 (premium paid for lower strike call) + $2 (premium received for higher strike call) = $5 per share.

- The lower strike call option is in-the-money, and the higher strike call option expires worthless.

- Outcome 3 (Stock Price Above $65):

- Both call options are in-the-money.

- Total Profit: $5 (maximum profit achieved when stock price is above $65) – $2 (premium paid for lower strike call) + $2 (premium received for higher strike call) = $5 per share.

- Both call options are in-the-money.

Conclusion

The Bull Call Spread Options Strategy is a bullish options strategy that provides limited risk and potential for profit. It is ideal for traders who expect moderate upside movement in the stock price. By combining buying a call option with selling another call option, this strategy reduces the cost of entering the trade while still allowing for potential gains.

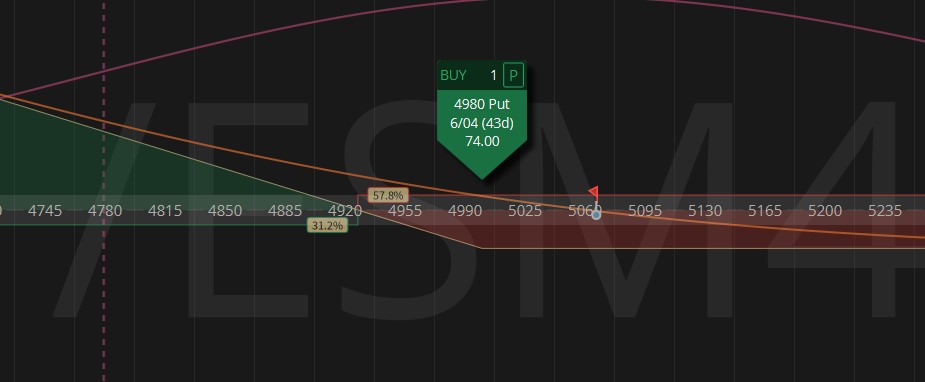

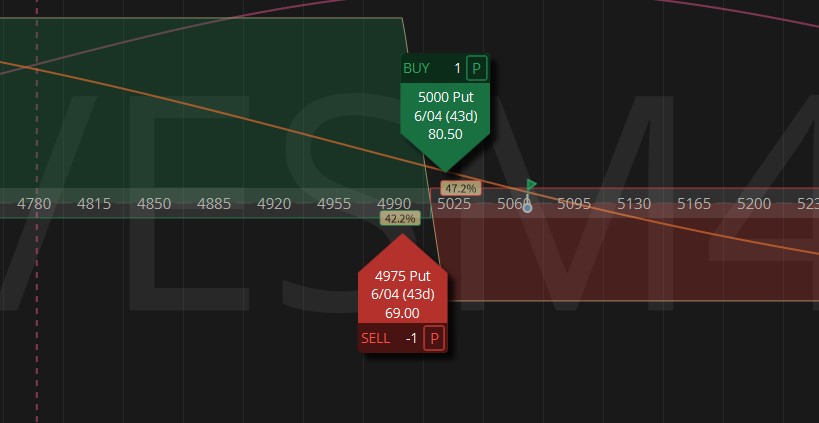

7: Bear Put Spread Options Strategy

The Bear Put Spread Options Strategy, also known as a “long put spread” or “debit put spread,” is an options strategy used when a trader is moderately bearish on a stock’s price. It involves buying a put option at a higher strike price and simultaneously selling a put option at an even lower strike price. This strategy allows the trader to profit from a potential downward movement in the stock price while reducing the cost of entering the trade.

Mechanics of the Bear Put Spread Options Strategy:

- Buy Put Option: Purchase a put option with a higher strike price.

- Sell Put Option: Simultaneously sell a put option with an even lower strike price.

- Same Expiration Date: Both put options have the same expiration date.

- Limited Risk, Limited Reward: The maximum loss and profit are limited.

Bear Put Spread Options Strategy Example:

Let’s say you’re considering the Bear Put Spread Strategy for XYZ stock, currently trading at $50 per share. You create the following spread:

- Buy Put Option: Strike Price $55, Premium $3 per share

- Sell Put Option: Strike Price $50, Premium $1 per share

Scenario:

- Outcome 1: Stock Price Above $55 at Expiration

- Both put options expire worthless.

- Total Loss: Combined premiums paid for both options.

- Both put options expire worthless.

- Outcome 2: Stock Price Between $50 and $55 at Expiration

- The higher strike put option is in-the-money, and the lower strike put option expires worthless.

- Total Profit: Difference between the strike prices minus the combined premiums paid.

- The higher strike put option is in-the-money, and the lower strike put option expires worthless.

- Outcome 3: Stock Price Below $50 at Expiration

- Both put options are in-the-money.

- Total Profit: Maximum profit achieved when the stock price is below the lower strike price ($50), minus the combined premiums paid.

- Both put options are in-the-money.

Benefits of the Bear Put Spread Options Strategy:

- Limited Risk: The maximum loss is limited to the combined premiums paid for the put options.

- Reduced Cost: Selling the lower strike put option helps offset the cost of buying the higher strike put option.

- Profit from Downside: The strategy profits from a downward movement in the stock price.

Risks and Considerations:

- Limited Profit Potential: The maximum profit is capped at the difference between the strike prices, minus the combined premiums paid.

- Stock Movement Required: The stock must fall to a certain level to be profitable.

- Time Decay: The value of the options decreases as expiration approaches.

Bear Put Spread Options Strategy Real-World Example:

Let’s look at a real-world example of the Bear Put Spread Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Option Contracts:

- Buy 1 Put Option with a Strike Price of $60, Premium $4 per share

- Sell 1 Put Option with a Strike Price of $55, Premium $2 per share

- Buy 1 Put Option with a Strike Price of $60, Premium $4 per share

Scenario:

- Outcome 1 (Stock Price Above $60):

- Both put options expire worthless.

- Total Loss: $4 (premium paid for higher strike put) – $2 (premium received for lower strike put) = $2 per share.

- Both put options expire worthless.

- Outcome 2 (Stock Price Between $55 and $60):

- The higher strike put option is in-the-money, and the lower strike put option expires worthless.

- Total Profit: $5 (difference between $60 and $55 strike prices) – $2 (premium paid for higher strike put) + $2 (premium received for lower strike put) = $5 per share.

- The higher strike put option is in-the-money, and the lower strike put option expires worthless.

- Outcome 3 (Stock Price Below $55):

- Both put options are in-the-money.

- Total Profit: $5 (maximum profit achieved when stock price is below $55) – $2 (premium paid for higher strike put) + $2 (premium received for lower strike put) = $5 per share.

- Both put options are in-the-money.

Conclusion

The Bear Put Spread Options Strategy is a bearish options strategy that provides limited risk and potential for profit. It is ideal for traders who expect moderate downside movement in the stock price. By combining buying a put option with selling another put option, this options strategy reduces the cost of entering the trade while still allowing for potential gains.

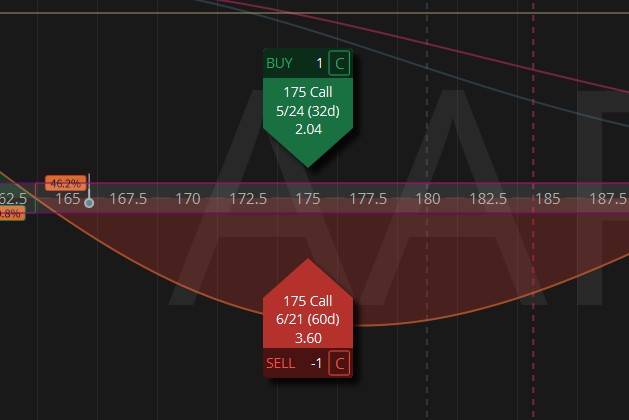

8: Calendar Spread Options Strategy

The Calendar Spread Options Strategy, also known as a “time spread” or “horizontal spread,” is an options strategy used when a trader expects the underlying stock to trade within a range over a specific period. It involves buying a longer-term call option or put option and simultaneously selling a shorter-term call option or put option with the same strike price. This strategy aims to profit from the difference in time decay between the two options.

Mechanics of the Calendar Spread Options Strategy:

- Buy Longer-Term Option: Purchase a call option or put option with a longer expiration date.

- Sell Shorter-Term Option: Simultaneously sell a call option or put option with a shorter expiration date.

- Same Strike Price: Both options have the same strike price.

- Profit from Time Decay: The strategy profits as time passes, particularly when the stock price remains near the strike price.

Calendar Spread Options Strategy Example:

Let’s say you’re considering the Calendar Spread Strategy for XYZ stock, currently trading at $50 per share. You create the following spread:

- Buy Longer-Term Call Option: Strike Price $50, Expiration in 3 months, Premium $5 per share

- Sell Shorter-Term Call Option: Same Strike Price $50, Expiration in 1 month, Premium $2 per share

Scenario:

- Outcome 1: Stock Price Below $50 at Expiration

- Both options expire worthless.

- Total Loss: Combined premiums paid for both options.

- Both options expire worthless.

- Outcome 2: Stock Price Near $50 at Shorter-Term Expiration

- The shorter-term call option expires worthless, and the longer-term call option retains value.

- Total Profit: Difference in premiums between the two options.

- The shorter-term call option expires worthless, and the longer-term call option retains value.

- Outcome 3: Stock Price Above $50 at Shorter-Term Expiration

- The shorter-term call option is in-the-money, and the longer-term call option has increased in value.

- Total Profit: Difference in premiums between the two options, minus initial cost.

- The shorter-term call option is in-the-money, and the longer-term call option has increased in value.

Benefits of the Calendar Spread Options Strategy:

- Profit from Time Decay: The strategy profits as time passes and both options approach expiration.

- Reduced Cost: Selling the shorter-term option helps offset the cost of buying the longer-term option.

- Neutral to Slightly Bullish/Bearish: Works well in range-bound markets or when expecting slight price movements.

Risks and Considerations:

- Limited Profit Potential: The maximum profit is capped at the difference in premiums between the two options.

- Stock Price Movement: The stock price should remain near the strike price for maximum profit.

- Time Decay Impact: Time decay can erode the value of both options, particularly the shorter-term option.

Calendar Spread Options Strategy Real-World Example:

Let’s look at a real-world example of the Calendar Spread Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Option Contracts:

- Buy 1 Call Option with Strike Price $60, Expiration in 6 months, Premium $7 per share

- Sell 1 Call Option with Strike Price $60, Expiration in 1 month, Premium $3 per share

- Buy 1 Call Option with Strike Price $60, Expiration in 6 months, Premium $7 per share

Scenario:

- Outcome 1 (Stock Price Below $60 at Shorter-Term Expiration):

- The shorter-term call option expires worthless, and the longer-term call option retains value.

- Total Profit: $4 (difference in premiums between the two options).

- The shorter-term call option expires worthless, and the longer-term call option retains value.

- Outcome 2 (Stock Price Near $60 at Shorter-Term Expiration):

- Both options retain some value, but the shorter-term option loses more due to time decay.

- Total Profit: Difference in premiums, adjusted for time decay.

- Both options retain some value, but the shorter-term option loses more due to time decay.

- Outcome 3 (Stock Price Above $60 at Shorter-Term Expiration):

- The shorter-term call option is in-the-money, and the longer-term call option has increased in value.

- Total Profit: Difference in premiums, minus initial cost.

- The shorter-term call option is in-the-money, and the longer-term call option has increased in value.

Conclusion

The Calendar Spread Options Strategy is a flexible strategy that allows traders to profit from time decay while maintaining a neutral to slightly bullish or bearish outlook on the stock. It can be effective in range-bound markets or when expecting slight price movements. Traders should monitor the options’ values and expiration dates closely to manage the trade effectively.

9: Protective Put Options Strategy

The Protective Put Options Strategy, also known as a “married put” or “portfolio insurance,” is an options strategy used to protect an existing stock position from potential downside risk. It is one of our top picks in this article “Top 10 Options Strategies for Traders” It involves buying a put option for each share of stock held. This strategy provides insurance against a drop in the stock price while allowing the investor to benefit from any potential upside movement.

Mechanics of the Protective Put Options Strategy:

- Buy Put Option: Purchase a put option for each share of stock held.

- Same Expiration Date: The put option and stock have the same expiration date.

- Strike Price Below Current Stock Price: The put option’s strike price is typically set below the current stock price.

- Limited Downside Risk: The put option acts as insurance, limiting potential losses if the stock price falls.

Protective Put Options Strategy Example:

Let’s say you own 100 shares of XYZ stock, currently trading at $50 per share. You decide to implement the Protective Put Strategy by purchasing put options with a strike price of $45.

Scenario:

- Outcome 1: Stock Price Above $45 at Expiration

- The put option expires worthless, but you still benefit from any increase in the stock price.

- Total Loss: Premium paid for the put option.

- The put option expires worthless, but you still benefit from any increase in the stock price.

- Outcome 2: Stock Price Below $45 at Expiration

- The put option is in-the-money, providing protection against further downside.

- Total Loss: Limited to the difference between the stock price and the put option’s strike price, minus the premium paid for the put option.

- The put option is in-the-money, providing protection against further downside.

Benefits of the Protective Put Options Strategy:

- Limited Downside Risk: The put option provides protection against significant losses if the stock price drops.

- Maintain Stock Ownership: Allows the investor to hold onto their stock position while reducing risk.

- Unlimited Upside Potential: The investor can still benefit from any increase in the stock price.

Risks and Considerations:

- Cost of Insurance: The premium paid for the put option is an additional cost.

- Stock Price Movement: The stock price must decline below the put option’s strike price to benefit from the protection.

- Time Decay: The value of the put option decreases as expiration approaches.

Protective Put Options Strategy Real-World Example:

Let’s look at a real-world example of the Protective Put Strategy in action:

- Stock: Company ABC

- Current Stock Price: $60 per share

- Number of Shares: 200

- Put Option Contracts:

- Buy 2 Put Options with Strike Price $55, Premium $3 per share

Scenario:

- Outcome 1 (Stock Price Above $55 at Expiration):

- The put options expire worthless, but you still benefit from any increase in the stock price.

- Total Loss: $600 (premium paid for 200 shares) = $3 per share.

- The put options expire worthless, but you still benefit from any increase in the stock price.

- Outcome 2 (Stock Price Below $55 at Expiration):

- The put options are in-the-money, providing protection against further downside.

- Total Loss: Limited to $55 – $60 = -$5 per share (stock price – put option’s strike price) + $3 (premium paid for each put option) = -$2 per share.

- The put options are in-the-money, providing protection against further downside.

Top 10 Options Strategies for Traders Guide Conclusion

The Protective Put Options Strategy is a popular strategy among investors who want to protect their stock positions from potential losses while still participating in any potential upside. It acts as insurance against a drop in the stock price, allowing investors to maintain their stock ownership with limited downside risk. Traders should carefully assess the cost of the put options and their risk tolerance before implementing this strategy.

Congratulations! You have now covered the Top 10 Options Strategies for Traders guide. Please Bookmark this page for future reference. You’ve now explored the top 10 options strategies for traders, each designed to boost profits and minimize risks in different market conditions. From basic strategies like the Covered Call and Protective Put to more advanced strategies like the Iron Condor and Calendar Spread, these strategies offer a range of tools for traders to navigate the options market.

Remember, this article on Top 10 Options Strategies for Traders is for education purposes only and options trading involves risks, so it’s important to fully understand each strategy before implementing it. Consider factors such as market conditions, volatility, and your risk tolerance when choosing a strategy. It’s also advisable to practice with paper trading or small positions before committing significant capital.