What are Bonds: An Overview and What You Should Know? The bond market is approximately 48 percent larger than the stock market. There is roughly ten times more debt issued than there is equity!

What are Bonds is a common questions asked online. It is much simpler to grasp the concept of a bond after first grasping the concept of a loan. When two parties agree to lend each other money, it’s called a loan. A lender (sometimes known as a “creditor”) is a party who makes a loan to another party.

The borrower (also known as “debtor”) is the person who takes out a loan and promises to pay it back, plus a fee (referred to as “interest”) for the privilege of borrowing.

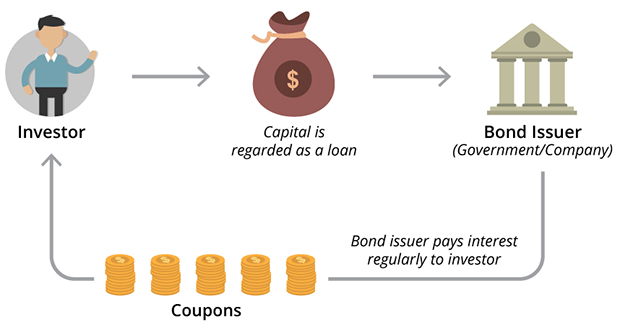

As a new “bondholder,” you agree to lend the borrower, or “issuer,” an agreed amount of money for a specified term until the bond’s “maturity,” which might vary from a few months to a few years. At maturity, the bond’s ‘face value’ is paid out by the issuer, who then pays down their debt.

A regular ‘coupon’ (‘interest’) payment may be made to the bondholders which owns the bond till maturity depending on the nature of the bond. Bonds of this type are referred to as “coupon” bonds. ‘Zero-coupon’ bonds are those that do not pay interest on a regular basis.

To be clear, zero-coupon bonds don’t pay out coupons. This bond is typically less expensive to buy than a coupon bond at face value at the beginning of the term. Nonetheless, just as with a coupon bond, the bond issuer will pay you the face value of the bond when the bond reaches maturity.

Bonds and loans are two different things.

People who own bonds can sell them to other people, and they can become the new bondholders. This is a big difference between bonds and loans. Of course, this means that the new bondholder can then sell it to another person, and so on. In contrast to loans, bonds can be traded.

So, the question that is always asked is what is the difference between bonds and stocks?

In contrast to stocks, if you own a bond, you do not own the other party in the transaction. Simply put, you’re making a loan to them. This signifies that you have an equity stake in the company. A bondholder can only expect the corporation to repay the loan they owe them. In the event of a default, the corporation must first pay back the debts owed to the bondholders, which is a significant difference. Afterwards, the stockholders will receive any remaining funds.

Differences between corporate and government bond issues

It is important to note that there are only two major issuers of bonds, which serves as a good starting point for discussing the risks and returns associated with them. Both the federal government and private companies issue these. Government-issued bonds are generally considered to be safer, and as a result, carry a reduced risk.

Governments are able to pay off debt more easily because they have more options, such as raising taxes, to do so. Countries aren’t exempt from ‘default’, the failure to pay back a loan, by claiming that.

This may be seen in Greece’s government-debt problem since 2009. To make sense of what happened in Greece, we suggest doing some further research on that subject. The story is truly fascinating, we highly recommend reading more about it. When discussing the dangers and rewards of bonds, the term ‘credit rating’ is the best example to use.

What are the Bond Risks: Credit Ratings?

Bonds are frequently used by investors as a hedge against the volatility of stock investments, but they come with their own set of drawbacks. These four letters allow investors to swiftly assess a country’s, company’s, or bond’s creditworthiness, ranging from the safest AAA (triple-A) to the already defaulted D.

Where do these ratings come from?

There is a good chance that you have heard of ‘Moody’s, S&P, or Fitch‘ if you have ever read the business section of a paper. Government and corporate bonds, as well as other types of financial instruments, are all given a letter from one of the many credit rating organisations throughout the world.

What are the chances that this company won’t make interest and face-value payments on time? They question themselves. What is the likelihood of default? Using measures such as debt, interest, and cash flow to get a sense of their financial health.

How are these bonds traded?

As with stocks, you can buy bonds when they first come out. This is called the “primary market,” and it’s where you can do this. When you’re done, you can buy bonds for companies that are on bond exchanges or that you can buy “over the counter” (OTC).

The OTC market is decentralised, meaning it is exchanged by broker-dealers and the price is reported on individual transactions instead of being exchanged at the previous price on a publicly traded exchange.

Investors can sell bonds before maturity with greater ‘liquidity,’ thanks to over-the-counter trading. Additionally, the average size of a bond trade is far larger than that of a stock trade.

This data from Xtrakter shows that a typical bond trade is between $1 and $2 million. It is important to take note though that trades over $2 million to $5 million happen much more often. When it comes to significant trades, the buyer and seller will occasionally negotiate terms with the dealer, which can only be performed over the counter.

A small brokerage fee of roughly $10 is also required when purchasing bonds on the secondary market. As with stocks, you can invest in bond Exchange Traded Funds (ETFs), which are portfolios of bonds that attempt to replicate the performance of a bond index. This eliminates the need for you to select particular bonds to invest in. We have covered ETFs in more detail in this post, recommended reading!

How can you make money by investing in bonds?

Investing in bonds can produce two types of returns: capital gains and coupon income if the bonds are held until maturity.

Bond price increases are a form of capital gain. If you acquired $5000 worth of bonds at face value and subsequently the valuation of these bonds grew to $10,000 and you sold them, you pocket the $5000 difference less any brokerage expenses during the trade. This is an example of capital gains.

Coupon payments are periodical payments made by bond issuers to bondholders to ‘service’ the bonds. Holding a bond to maturity and being a long-term investor means the issuer will pay the face value of the bond as well as any coupons you get.

Suppose you have a 10-year bond with a 5% coupon rate and you hold on to it till the end of the term. The bond issuer would of payed you $50 for every $1000 in face value you retain each year until maturity.

The distinction between coupons and dividends (payments from stocks) is that coupons are more certain than dividends because they constitute an obligation, agreed in writing and at the time of bond issuance. The coupon rate stays the same. In contrast to dividends, where the business has control over the frequency and quantity of payments, this has no such discretion.

In summary

Investing in a portfolio that includes both safe and risky investments requires a healthy dose of bond holdings. As people age, these investors at this stage of their journey tend to put more of their money into bonds because of the decreased risk.

However, it is ultimately up to you on how much risk you want to accept and what you want to achieve with your the investments you make. Always remember you have options.

You don’t have to limit yourself to stocks and bonds when it comes to investing: There are Gold Investment options and Digital Currency Investment option like Bitcoin to consider for a well-balanced investment portfolio.