With its AUD $40.4 million investment, Rio Tinto will gain an initial 15% stake in Sovereign Metals. The money from the investment will be put towards developing the Kasiya Rutile-Graphite Project in Malawi.

Rio Tinto Mining and Exploration Limited has made an investment of strategic significance of AUD $40.4 million in Sovereign Metals Limited (ASX: SVM and AIM: SVML) to further develop the world-class Kasiya Rutile-Graphite Project in Malawi.

At an initial subscription price of AUD $0.486 per share, Rio Tinto has committed to purchasing 83,095,592 new fully paid ordinary shares (Shares) in Sovereign Metals for a total of AUD $40.4 million. Rio Tinto will own around fifteen percent of the common shares of the business after paying a subscription cost that is 10% above the 45-day volume weighted average price on the ASX as of the closing bell on July 14, 2023.

Within 12 months of the original participation, the business said that Rio Tinto will be offered options to purchase an additional 34,549,598 Shares in Sovereign Metals, which could boost Rio Tinto’s stake in the business to as high as 19.99%.

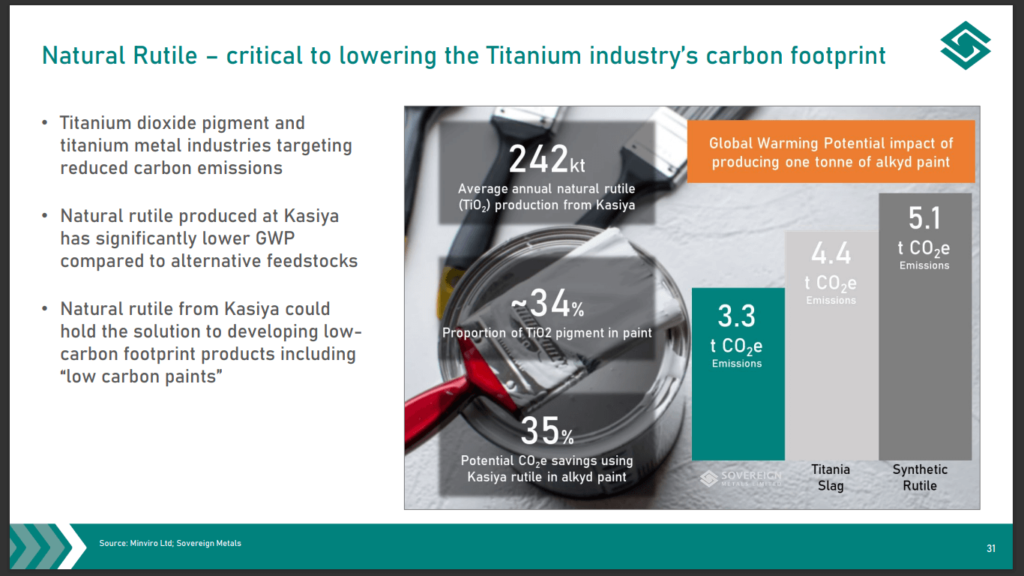

Funding for the Kasiya Rutile-Graphite Project located in Malawi will come from Rio Tinto’s strategic purchase, and the company plans to use the money to move forwards with a Definitive Feasibility Study for creating a world-class, low-CO2-footprint mine that can supply the titanium pigment, titanium metal, and lithium battery sectors.

Sovereign Metals said that Rio Tinto will additionally execute an Investment Agreement, that will be subjected to specific conditions, such as the initial issuance of Shares to Rio Tinto under the Subscription Agreement, time, and ownership thresholds, among other considerations.

The Kasiya Rutile-Graphite Project

The Kasiya Rutile-Graphite Project in central Malawi contains the world’s largest natural rutile deposit and is also a major source of Natural Flake Graphite. Sovereign’s long-term plan is to establish a productive business that can continue to provide the world’s markets with the rare and valuable natural rutile and graphite they demand.

The Company’s June 2022 announcement of an Expanded Scoping Study (ESS) verified Kasiya’s potential as a big, low-cost producer of natural rutile and natural graphite with a global warming potential significantly lower than that of other current and proposed facilities.

The organisation is now conducting an ESS-based Pre-feasibility Study (PFS) for Kasiya. In the upcoming weeks, the Company plans to make an announcement about the results of the pre-feasibility study (PFS).